Depreciation tax shield calculator

Depreciation is basically a way to spread out the expense of buying a business asset over the life of that asset. Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income.

1

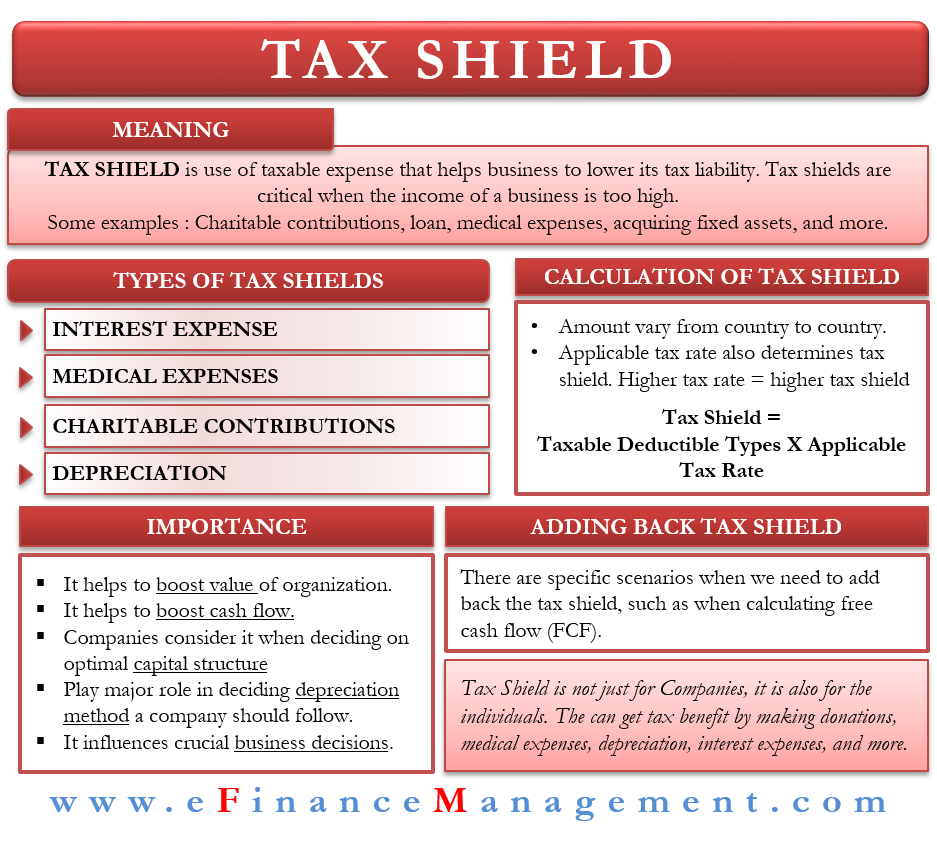

In general a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation.

. In this article you will learn. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense. There are two simple steps to calculate the Depreciation Tax Shield of a company.

This companys tax savings is equivalent to the interest payment multiplied by the tax rate. Boat depreciation calculator. Accelerated depreciation allows you to depreciate more of the asset in the first.

When a company purchased a tangible asset they are able to. After-tax benefit or cash inflow calculator. GAAP depreciation reduces the book value of a companys property plant and equipment PPE over its estimated useful life.

You calculate depreciation tax shield by taking 100000 X 20 20000. As such the shield is 8000000 x 10 x 35 280000. How to calculate the tax shield.

Additionally tax shields also play an. Formula to Calculate Tax Shield Depreciation Interest The term Tax Shield refers to the deduction allowed on the taxable income that eventually results in the reduction of taxes owed. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedTax shield can be claimed for a charitable contribution.

It should be noted that regardless of what depreciation. What is the amount of the annual depreciation tax shield for a firm. Blue cross blue shield breast reduction calculator.

How to Calculate the Depreciation Tax Shield. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. Carpet depreciation calculator.

Depreciation or CCA tax shield depreciation or CCA amount x. The Depreciation Tax Shield refers to the tax savings caused from recording depreciation expense. Even though the everybody uses the market value of debt rather than the book value this idea does not extend to the interest tax shield.

Depreciation Tax Shield Calculator Calculator Academy Depreciation Tax Shield Definition. This is equivalent to the. 75000 The correct answer is a.

Depreciation Tax Shield Sum of. Master the Depreciation Tax Shield concept so you can use it on the job in Investment Banking Private Equity and Investment Management. Discover types of cash inflow and outflow and examine how cash flows.

It is important to have the depreciation numbers along with the income tax rate of. Depreciation is considered a tax shield because depreciation expense. The calculation of depreciation tax shield can be obtained by depreciation expense and tax rate as shown below.

Depreciation Tax Shield Formula. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation. Units of production depreciation calculator.

Depreciation tax shield calculator.

Tax Shield Formula How To Calculate Tax Shield With Example

Depreciation Tax Shield Formula And Calculator Excel Template

Depreciation Tax Shield Formula And Calculator Excel Template

1

What Is The Net Present Value Npv How Is It Calculated Project Management Info

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

1

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

1

Tax Shield Calculator Efinancemanagement

Interest Tax Shield Formula And Calculator Excel Template

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Calculator Calculator Academy